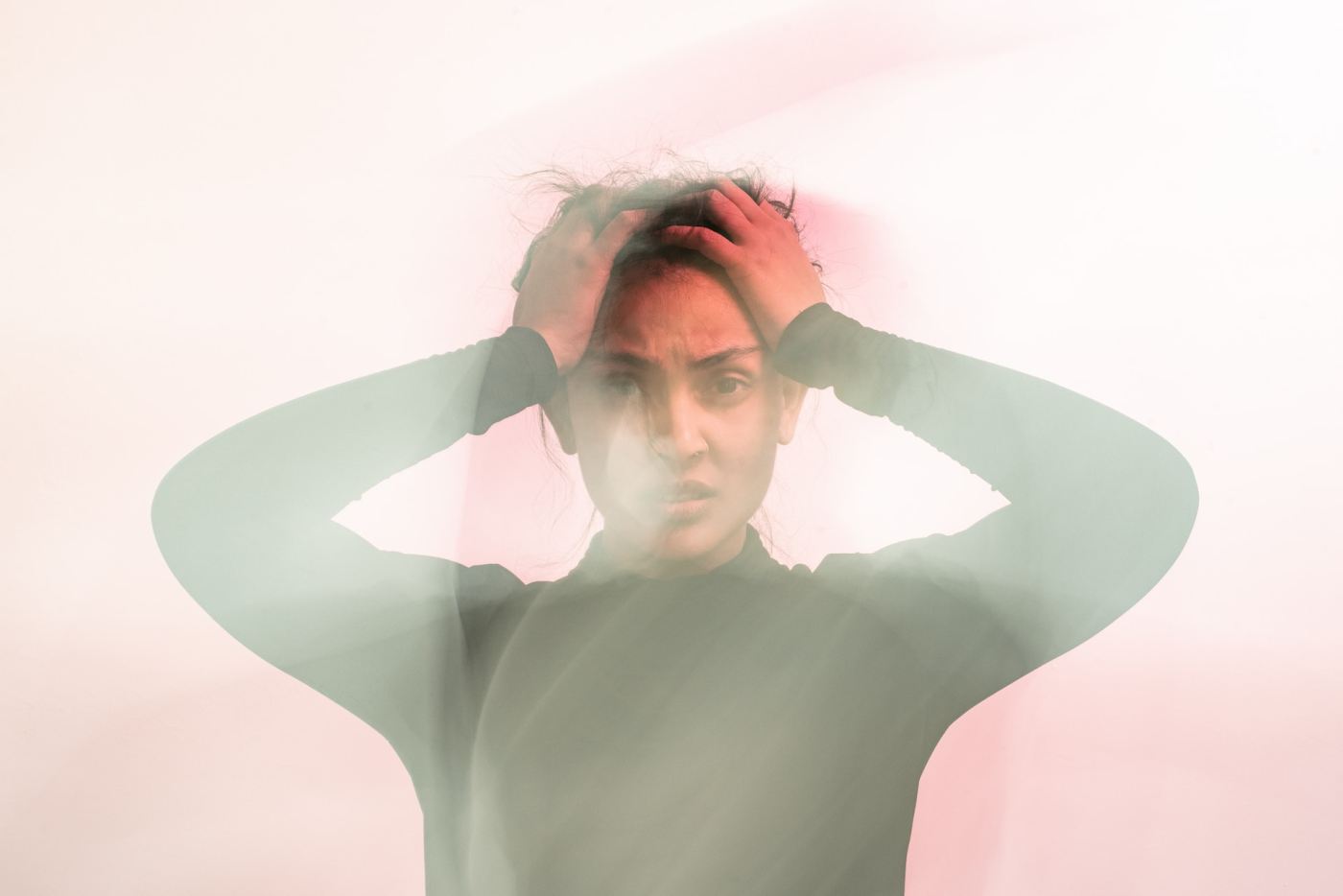

Money can be a difficult thing to talk about. Because of the stress and other uncomfortable discussions it can lead to, it’s no wonder that so many feel anxiety about money.

According to a survey by Capital One and The Decision Lab, 77 percent of Americans report feeling anxious about their financial situation. This included aspects about both their future (such as retirement and keeping up with the cost of living) to more short-term concerns (like living paycheck to paycheck and managing debt).

Heightened anxiety can be a silent killer. Not only can it negatively affect your day-to-day activities, but it can also cause significant physical stress on your body that may lead to other unwanted problems.

For the sake of your personal well-being and those who care about you, it’s worth taking a step back, getting your bearings, and making the necessary changes. Here’s how you can start reducing your feelings of anxiety over money.

Control What You Can Control

Anxiety is rooted in the presumption that something we don’t want to happen will happen. As humans, we naturally like to think we’re the leaders of our own destinies. This is why we sometimes attempt to control everything and everyone around us.

However, that’s just not possible. Life is full of surprises. When it comes to our finances, there are so many things that can and will happen that we cannot influence.

- Inflation will cause prices to up

- Stocks will go down and drag down your nest egg

- Jobs will be in jeopardy because of a bad economy

These things occur all the time – they’re unavoidable. But that doesn’t mean you need to be a victim. If you know in advance that the unpredictable may eventually happen, then at a minimum you can plan for the unplanned.

A good example of this is insurance. You don’t know when you’ll develop a health problem or get into an auto accident. But when you do, you’ll need your insurance to kick in and cover the cost. Having the right insurance is the part that you CAN (and should) control.

You can do the same thing for both your short-term and long-term finances. In the short term, you can control things such as:

- Keeping track of your spending. Use a budgeting app like Buxfer that seamlessly connects with your banks and credit cards to consolidate all of your transactions into a single report.

- Actively avoid debt. Don’t make any unnecessarily large purchases, especially if it involves getting yourself into debt.

- Building up your emergency fund. Your emergency fund is like your own private insurance policy. The closer you are to having 3 to 6 months’ worth of living expenses stashed away, the better equipped you’ll be.

Though controlling your long-term goals may be a little harder to do, something that can really help is to make them as intentional as possible. Lofty goals like “I will retire someday” are too abstract and easily dismissive. Instead, articulate them in a way that makes them more specific:

- I will retire by the time I’m 55.

- I will be earning $100,000 per year by the time I am 40.

- I will buy my first investment property within the next year.

While you may or may not actually achieve them, there’s certainly a much higher probability that they will come true if you know what you’re working towards and calibrate your efforts towards being successful. That’s something you can control.

Build Your Financial Buffer

Another major source of anxiety related to money for many people is how close they are to becoming financially ruined if something bad were to happen.

Consider:

- A job loss

- An accident that causes you to be off work for an extended amount of time

- An unexpected bill for a significant amount of money

In this circumstance, I like to take a lesson from one of the most famous investors of our time, Warren Buffett. When he’s evaluating potential businesses, something he likes to see is that they have a moat around them.

Having a “moat” refers to the days of the middle ages when kingdoms would defend themselves from opposing armies by digging a trench around the castle and filling it with water. What Buffett means by this is he likes when a business has taken steps to insulate itself from outside economic forces.

From a personal financial standpoint, I believe the same lesson could be applied. As we already mentioned, you can certainly build a buffer around your “kingdom” by creating an emergency fund.

However, why stop there? Why not install several layers of financial firewalls by doing things like:

- Having adequate amounts of insurance coverage across various insurance policies

- Building up your retirement funds

- Acquiring income-producing assets

Think of how much more secure you’d feel knowing you have each of these resources at your disposal. There’d be less chance for anxiety because you’d know that you’d be able to confidently handle and move past anything life threw your way.

Adopt an Abundance Mindset

Finally, sometimes the anxiety we feel comes from our own perception of the things around us and not how they really are.

A good example of this is our jobs. As a society, we tend to let ourselves believe that salaries define who we are. We furthermore let ourselves believe that we’re somehow “locked” into this amount we earn, and there’s no other way out unless we get a raise or promotion. However, that’s just not true.

Your job doesn’t dictate how much you’re worth or capable of earning. On top of that, it doesn’t have any control over how you grow your financial empire. There’s nothing stopping you from:

- Learning more about investing works

- Starting a side hustle or business

- Acquiring income-producing assets like dividend stocks or rental properties

Something in your mind might say:

- I don’t know how …

- All the good opportunities have already been taken …

- I don’t deserve this …

- I tried this before and it didn’t work …

But these are just self-imposed excuses. If you open your eyes and start to look around, you’ll find that there are opportunities all around you just waiting to be had. You just need to recognize them and take action.

Remember: Control what you can control. Whatever you did in the past that did or didn’t work, let it go. Commit to believing there is something good financially for you out there. Ask enough of the right questions and put the proper habits in place, and sooner or later you’re going to find it.

Featured image credit: Unsplash