Millennials have certainly endured their fair share of economic challenges over the past few decades. Defined as anyone born between 1981 to 1996, many of these individuals struggled to find or keep a job during the Great Recession of 2008. In fact, well-known millennial blogger Grant Sabatier shares in his book Financial Freedom how he... Continue Reading →

3 Ways Credit Card Interest Hurts You

Most people know that if you don’t pay off your credit cards each month you’ll be charged interest. However, for one reason or another, so many of us allow this debt to accumulate anyways. According to research by Go Banking Rates, more than half (53 percent) of Americans carry a revolving balance on their credit... Continue Reading →

5 Reasons to Watch Out for Buy Now, Pay Later

Lately when you've been shopping online with major retailers, you've probably noticed a new payment that makes the price look much "smaller" than it really is. If you were to click this option, you'd be taking advantage of a service called "Buy Now, Pay Later". Buy Now, Pay Later is when the total price of... Continue Reading →

12 Important Changes Coming to Retirement Plans

On December 23, 2022, President Biden signed into law a $1.7 trillion budget bill that included some incredibly major changes for the retirement plans that people like you and I use each day. This section of the legislation has been dubbed the SECURE 2.0 Act of 2022. (Just for reference, SECURE stands for “Setting Every... Continue Reading →

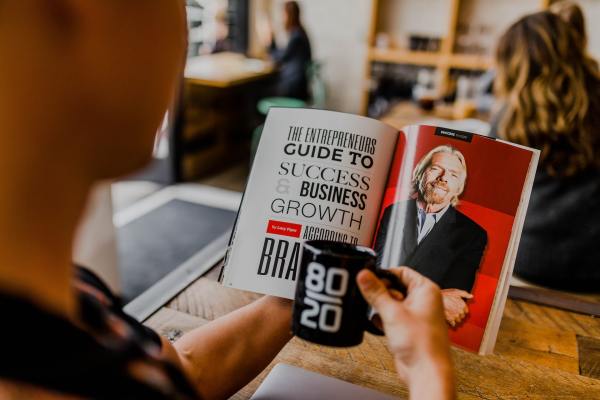

7 Things Millionaires Do Differently from Everyone Else

Why is it that some people become millionaires and others don't? Is it because they're the beneficiaries of wealth handed down from older family members who were rich? Surprisingly, no! Surprisingly, a lot of today's millionaires are self-made and came from humble beginnings not much different than you and me. Thanks to more economic opportunities... Continue Reading →

Biden’s New Student Loan Repayment Plan Announced

While millions of federal student loan borrowers are eagerly awaiting to see if the supreme court allows President Biden to fulfill his promise of forgiving as much as $20,000 in debt per student, the Department of Education has silently released the details of a new student loan repayment plan - one that could be just... Continue Reading →

8 Ways to Lower Your Home Energy Bill

If there’s one place where budgets were really hit hard last year, it’s home energy costs. Due to inflation raising the cost of nearly everything, fuel prices increased by 28% for natural gas, 27% for heating oil, 10% for electricity, and 5% for propane leading into the winter. That means in most households, they saw... Continue Reading →

5 Investment Resolutions to Make for the New Year

The start of the new year is a great time to make changes for the better. While things like your health and relationships should always be at the forefront of your priorities, refining your investment style will also make a huge impact on your well-being. In this post, we’ll go through five important investment resolutions... Continue Reading →

5 Ways to Save More Money in 2023

2022 was undoubtedly a rough year for many people financially. Between record-breaking inflation, rising interest rates, and a plunging stock market, there were a lot of forces working against most American households. Yet, that doesn’t mean that we can’t loop optimistically to the new year and start off on the right foot. With that said,... Continue Reading →

What Higher Interest Rates Mean for You

2022 has been a whirlwind year for interest rates. The year started off with the federal funds rate (i.e., the interest rate range set by the U.S. Federal Reserve) between 0.25% to 0.50%. However, after multiple unprecedented rate hikes - escalating at one of the fastest paces in 40 years - the new federal funds... Continue Reading →